Abstract

Information on ship traffic on the Northern Sea Route (NSR) has been lacking. Previous studies have analyzed transit shipping via the NSR, but no data has been available on the overall traffic volume (number of voyages) and the magnitude and characteristics of domestic and destination shipping. Information on shipping trends and the role of Russian and non-Russian shipping companies in ongoing shipping operations has been incomplete. This study provides such statistical data and evaluation of traffic on the NSR during 2016–2019 and discusses policy implications for future NSR shipping. The study shows that Russian domestic shipping dominates shipping activities on the NSR in terms of number of shipping companies, vessels and voyages. There are much fewer Asian shipping companies working on the NSR than European companies, contrary to media reports that often depict a large Asian shipping influence on the NSR. Much more frequent voyages are also taking place between the NSR and European ports than ports in the Asian Pacific region. Developing logistics operations involve year-round shipments of commodities from remote locations within the NSR to ice-free transshipment and storage hubs located outside the NSR, but within Russia.

Keywords

Northern Sea Route (NSR); Arctic shipping; Ship traffic analysis; International transits; NSR transport system

1. Introduction

Ship traffic is increasing in the Arctic, facilitated by rapid reduction in sea ice cover and ice thickness as a result of global warming, resulting in greater marine access and longer navigation seasons. The main economic driver for this increased shipping activity in the Arctic is natural resource exploitation and global market demands for commodities.

The nature of this shipping activity is not always well understood. The Arctic Council’s Arctic Marine Shipping Assessment [1] provided the first overview of circumpolar Arctic shipping based on collected ship traffic data from the Arctic states for 2004. The aim was to quantify the number of voyages and better understand the potential environmental impacts of Arctic marine shipping operations. Eriksen and Olsen [2] and Eguiluz et al. [3] did a similar circumpolar study by examining shipping activity in the Arctic between 2010 and 2015, and Silber and Adams [4] between 2015 and 2017, based on Automatic Identification System (AIS) data. Again the aim was to identify areas where shipping concentrates and provide monthly and yearly assessments of the spatial distribution of ship density in the circumpolar Arctic.

More information is available on ship traffic on the Northwest Passage in the Canadian Arctic [5], [6], [7] than along the Northeast Passage and the Northern Sea Route (NSR) off the northern coast of Russia (Fig. 1). Only a handful of studies have assessed recent ship traffic on the NSR and then only for international transit voyages [8], [9], [10], [11], [12], [13], [14] which are only a very small fraction of the overall shipping activity taking place on the NSR as this study clearly demonstrates.

(source: CHNL Information Office).

Zhang et al. [14] pointed out the lack of ship traffic analysis and information on what is exactly happening on the NSR. They also stressed the need to fill the gap between economic viability studies and actual ship traffic statistics on the NSR by identifying key players and shipping patterns. Zhang et al. [15] stated that present lack of ship traffic data is making it difficult to both identify and quantify risks compared to the traditional routes via the Suez Canal. Recently Li and Otsuka [16] provided in a conference paper more comprehensive information on shipping activities on the NSR, including ship types, the range in deadweight tonnage and daily ship positioning between 2013 and 2017, based on data from the Russian Northern Sea Route Administration (NSRA).

This article’s main objective is to provide an empirical update and quantify and evaluate ship traffic and traffic flow on the NSR during 2016–2019 and determine the significance of domestic shipping, destination shipping, and international transit shipping in the overall shipping activities. The second objective is to assess the role of Russian and non-Russian shipping companies in NSR shipping. The final objective is to show developing shipping trends, identify the main drivers for ongoing and future shipping and highlight some policy implications for future development of the NSR’s transport system.

With projected rapid increase of ship traffic on the NSR, it is hoped that the study will provide a baseline or reference point for evaluation of future changes in shipping activities on the NSR. The goal is to give maritime businesses, researchers, governmental authorities, policymakers and other Arctic stakeholders a better understanding of recent shipping activities and what this could mean for future Arctic shipping. In a forthcoming article recent developments in maritime logistics on the NSR will be further analyzed and discussed.

The article is structured in such a way that Session 2 describes the methodology; Session 3 evaluates ship traffic flow and traffic characteristics on the NSR in 2016–2019; Session 4 discusses the developing shipping trends and future prospects of shipping on the NSR; and Session 5 presents the main conclusion.

2. Methodology

2.1. Data sources and methods

The empirical data for this study comes from two separate datasets: 1) The Centre for High North Logistics’ NSR Shipping Database, managed by the CHNL Information Office in Murmansk. The database is based on satellite AIS data provided by the Canadian satellite company exactEarth; and 2) an official list of registered vessels working on the NSR each year provided by NSRA in Moscow, which includes key vessel characteristics such as vessel type and ice class, ship owner/operator and daily reports of vessels’ geographic locations near and within the NSR Water Area. Additional information on vessels’ characteristics came from online ship registry databases.

Due to current limited shipping activity on the NSR compared to most other sea areas, all vessels’ AIS transmissions were processed manually in real-time and downloaded to a database. All vessels that were officially registered working on the NSR were monitored and details of all their voyages recorded (AIS signals recorded every 5–20 min). This included the time and place of each vessel’s port of origin; the location, time and date of entry to the NSR and departure from the NSR; the actual sailing information en route; and the time and place of arrival to the destination port (origin-destination, OD pairs). This information was then used to determine the total number of vessels and voyages on the NSR and the number of domestic, destination and international transit voyages over the four years. This included recording the names and nationalities of ship owners/operators working on the NSR. The recorded AIS transmissions were also used to map the actual sailing tracks of vessels.

The study benefitted from consultation with several shipping companies working on the NSR, including the Russian nuclear icebreaking operator Atomflot. As secondary sources of information, several internet sources were used in clarifying the nature of various shipping activities during the four years – on ship companies’ websites, maritime newsletters, trade journals and press releases.

2.2. Study area and definitions

The area of study is the NSR Water Area (hereafter NSR) along the northern coast of Russia as defined in the Merchant Shipping Code of the Russian Federation of 1999 (Fig. 1).

The following definitions apply to this study. Voyage: If a ship leaves a port and arrives at another port (or in another area, e.g. for a research vessel that does not call at a port) then this is considered one voyage. When the same vessel departs from the first port or water area and returns to another port or destination then this becomes a second voyage. Voyage on the NSR: A voyage that originates from within the NSR, arrives to the NSR, or transits the NSR. These restrictions are the same as used by Russian authorities in assessing ship traffic and cargo volume on the NSR. This means that ship traffic within the Barents Sea (including the Pechora and White Seas) that does not cross the western board of the NSR at Novaya Zemlya is not considered here, and the same applies for ship traffic in the Bering Sea that does not cross the Bering Strait, as these seas are outside the defined borders of the NSR. Subsequently, crude oil transport from both Varandey terminal and the Prirazlomnaya oil platform (both in the Pechora Sea) to Murmansk are not included in this study.

A domestic voyage on the NSR is a voyage between two Russian ports/locations. A destination voyage on the NSR is a voyage between a Russian port and a non-Russian port. A transit voyage on the NSR is a voyage via the NSR crossing both the western and eastern borders of the NSR without calling at intermediate ports/locations along the route. An international transit voyage on the NSR is a voyage between two non-Russian ports via the NSR. The summer-autumn navigational season on the NSR extends from the beginning of July to the end of November (5 months). The winter-spring navigational season extends from the beginning of January to the end of June plus December (7 months).

3. Results: ship traffic on the NSR in 2016–2019

3.1. Background

Russia regulates all shipping on the NSR. Russia does this based on Article 234 of UNGLOS but also on historical grounds which defines the NSR as a national unified transport route of the Russian Federation (see [17], [18]). Article 234 gives Arctic coastal states the right to adopt and enforce non-discriminatory laws and regulations for the prevention, reduction and control of marine pollution from vessels in ice-covered areas in the Arctic within the limits of their exclusive economic zone. Russia’s interpretation of UNCLOS 234 has been contested by some states. Shipping companies planning to sail the NSR must apply for a permit to Russia’s Northern Sea Route Administration (NSRA). The administration determines whether icebreaker escort is required or if the ship can navigate independently, based on the navigational season, ice conditions, and the vessel’s ice class (see details in [19]).

The number of officially registered vessels working on the NSR each year is significantly less than the number of shipping permits granted by the NSRA ([20]; Table 1). A large majority of vessels with permits but not officially registered as actually sailing on the NSR are Russian river vessels including barges, dredgers, tugboats, floating cranes and rafts that very likely never entered the NSR, but still apply for permits each year. Additionally, such vessels do likely not have the technical ability to provide required daily reporting to the NSRA in Moscow and are not equipped with AIS transmitters. Some registered vessels applied for more than one permit and a few foreign flagged vessels with permits but not registered probably cancelled their scheduled voyages. In any case, the number of sailing permits is a very poor indicator of maritime shipping activity on the NSR.

Table 1. Ship traffic activity (number of voyages) on the NSR in 2016–2019.

| Departure and arrival destinations | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| From NSR to Russian ports | 599 | 591 | 564 | 646 |

| From western Russian ports to NSR | 576 | 537 | 537 | 609 |

| From eastern Russian ports to NSR | 46 | 30 | 33 | 44 |

| Between NSR ports | 263 | 580 | 563 | 736 |

| From NSR to European ports | 78 | 62 | 144 | 287 |

| From European ports to NSR | 65 | 63 | 137 | 272 |

| From NSR to NE Asian ports | 15 | 4 | 4 | 21 |

| From NE Asian ports to NSR | 36 | 9 | 10 | 25 |

| Transits via NSR (total) | 18 | 28 | 27 | 37 |

| Domestic transitsa | 5 | 12 | 8 | 15 |

| Destination transitsb | 5 | 4 | 2 | 8 |

| International transits | 8 | 12 | 17 | 14 |

| Other departure/arrival destinations | 9 | 4 | 3 | 17 |

| Total number of voyages | 1705 | 1908 | 2022 | 2694 |

| Total number of different vessels | 297 | 283 | 227 | 278 |

| Total number of shipping companies | 129 | 121 | 90 | 119 |

| Total number of sailing permits (NSRA) | 718 | 644 | 792 | 799 |

b. Destination transits are transit voyages on the NSR between a Russian port and a non-Russian port.

3.2. Ship traffic statistics on the NSR in 2016–2019

3.2.1. Vessels, voyages and cargo volumes

A total of 8329 separate voyages took place on the NSR in 2016–2019. The number of vessels working on the NSR each year ranged between 227 and 297 and the number of voyages increased from 1705 to 2694, or by 58%. The increase in the number of voyages during the four years was the result of increased internal traffic on the NSR (by mainly service/supply vessels and icebreakers) as well as increase in destination shipping between SW Kara Sea and European ports (by LNG carriers and gas condensate tankers). Table 1 shows the number of voyages by departure and arrival destination and Fig. 2 the number of vessels and voyages per month. Majority of voyages took place between July and October. Less than 50 vessels were working during the winter-spring season on the NSR and only within the SW Kara Sea, the Ob Bay and Yenisei River.

During the four years the cargo volume on the NSR increased from 7.5 million tons in 2016–31.5 million tons in 2019, a 4-fold increase (Fig. 3). Most of the cargo was for export to the European market consisting of liquid hydrocarbons supplied by two natural resource projects in the Ob Bay – LNG and gas condensate from the Yamal LNG plant at the port of Sabetta and crude oil from the Arctic Gate terminal at Cape Kammeniy (Novy Port) further south in the Ob Bay. In 2019, 254 shipments of LNG were brought from Sabetta by 23 LNG carriers to foreign markets and 41 shipments of gas condensate by 6 tankers. In addition comes transport of prefabricated LNG modules for the construction of the Yamal LNG plant, delivered to the port of Sabetta in 2016 and 2017,

(source: NSRA).

Cargo on the NSR had peaked in 1987 at 6.6 million tons, but declined sharply with the dissolution of the Soviet Union to about 1.6 million tons in 1996 (Fig. 3). Prior to 2016 majority of the cargo was deliveries of supplies, construction materials, equipment and fuels to remote Arctic communities (referred to as “northern deliveries”) during the summer-autumn season; construction material and equipment for port development at Sabetta (which started in summer 2012); and year-round deliveries since 1978 of nickel, copper and other non-ferrous ores and metals from the port of Dudinka (Nornickel) on the Yenisei River to Murmansk, and occasionally directly to European markets.

Total cargo transported on international transit voyages during the four years amounted to only 980,676 tons (Fig. 3).

3.2.2. Domestic shipping

Domestic shipping was the dominant type of shipping activity on the NSR with 87% of all voyages in 2016, 92% in 2017, 84% in 2018 and 76% in 2019 (Table 1 and Fig. 4).

Of the four coastal seas along the NSR, the Kara Sea/Ob Bay is by far the most frequent shipping destination (Table 2 and Fig. 1). The main ship traffic was between the NSR and the western Russian ports of Murmansk and Arkhangelsk. Highlighting the importance of both Murmansk and Arkhangelsk for the NSR, the two service and supply hubs (and transshipment in the case of Murmansk) were either departure or arrival destinations of 50% of all voyages on the NSR in 2018. Most of these voyages were to or from the port of Sabetta and the Arctic Gate oil terminal at Cape Kamenniy in the Ob Bay, and the port of Dudinka on the Yenisei River (Fig. 5). Crude oil from Cape Kamenniy and non-ferrous metals from Dudinka are first shipped to Murmansk before onward deliveries to European markets. Both Murmansk and Arkhangelsk were the delivery ports of construction materials, equipment, machinery, and supplies for the construction of the port of Sabetta, upgrading of the port of Pevek in the East Siberian Sea, and for the construction of several remote military bases on Russian Arctic islands and archipelagos. In 2019 similar work started for construction of the Utrenniy terminal for the Arctic LNG-2 project on the Gydan Peninsula in the Ob Bay.

Table 2. Number of port-of-calls/arrivals to the Russian Arctic coastal seas and rivers along the NSR (see Fig. 1).

| Arrival locations | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Kara Sea | 96 | 174 | 185 | 235 |

| Gulf of Ob | 504 | 483 | 558 | 901 |

| Yenisei River | 105 | 97 | 90 | 96 |

| Ob River | 2 | 6 | 0 | 3 |

| Irtysh River | 1 | 7 | 5 | 5 |

| Laptev Sea | 88 | 129 | 167 | 139 |

| Lena River | 25 | 42 | 29 | 26 |

| Yana River | 7 | 12 | 20 | 28 |

| Khatanga River | 2 | 19 | 9 | 12 |

| Anabar River | 6 | 13 | 7 | 15 |

| East Siberian Sea | 76 | 121 | 124 | 138 |

| Kolyma River | 20 | 45 | 58 | 52 |

| Indigirka River | 4 | 0 | 0 | 0 |

| Chukchi Sea | 22 | 56 | 30 | 42 |

| Total number of calls | 958 | 1204 | 1282 | 1692 |

| Different locations | 51 | 84 | 62 | 61 |

(source: CHNL Information Office).

Other frequent destinations on the NSR during the summer-autumn season were Dikson on the Kara Sea; Tiksi, Khatanga, Yana River, and Cape Bykov bordering the Laptev Sea; and Pevek and Cape Zeleniy bordering the East Siberian Sea (Table 2).

Russian owned/operated shipping companies were 62–73% of all shipping companies working on the NSR in 2016–2019, and owned/operated 66–83% of all vessels and made 75–87% of all voyages on the NSR (Fig. 6).

European companies were also participants in domestic shipping (cabotage) on the NSR, with up to 23 companies working each year and making a total of 269 voyages during the four years. These companies provided general cargo vessels, bulkers, heavy lift carriers, and offshore support vessels. Most of these voyages were between Murmansk and Sabetta and locations offshore in the Kara Sea and in the Ob Bay. Norwegian shipping companies operated service and supply vessels in the Kara Sea in support of drilling operations, and companies from Luxembourg, Netherlands and Belgium provided dredging services in the Ob Bay in 2016–2017. Chinese company operated a drilling rig.

3.2.3. Destination shipping

Destination shipping on the NSR was 12% of all voyages in 2016, 8% in 2017, 15% in 2018, and 23% in 2019 (Table 1 and Fig. 4).

From 2016–2019 there were 1232 destination voyages on the NSR: 1108 between the NSR and European ports, and 124 between the NSR and Asian ports. The NSR port of origin/destination was almost exclusively Sabetta in the Ob Bay. The number of European shipping companies/operators is also much greater than the number of Asian companies (Fig. 6). In 2016 and 2017 most of these voyages were deliveries of prefabricated LNG modules and other project cargo by heavy lift carriers and general cargo vessels for the Yamal LNG plant at the port of Sabetta. These project shipments were completed in September 2017. Though the LNG modules were initially shipped from several construction yards in China and Indonesia most were transported by European shipping companies via the Suez Route to Sabetta, or first to Zeebrugge in Belgium and some other European ports, before onward shipment to Sabetta. Several shipments also came through the Bering Strait during the summer-autumn season. The majority of the European companies transporting heavy lift cargos to Sabetta were from the Netherlands (e.g., in 2016: 6 Dutch companies with 26 heavy lift vessels making 80 voyages to and from Sabetta) followed by companies from Germany.

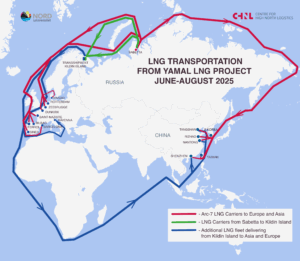

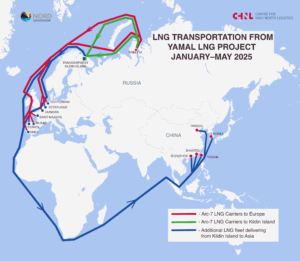

The sharp increase in the number of voyages between the NSR and European ports starting in 2018 (Table 1 and Fig. 4) was due to shipments of LNG (and gas condensate) from the Yamal LNG plant at the port of Sabetta to western European ports for LNG unloading or transshipment, and return voyages back to Sabetta. First such shipment took place in late December 2017. To avoid sailing high ice-class (Arc7) LNG carriers, which for a while were in short supply, all the way to western European ports, ship-to-ship transshipment of LNG to conventional carriers before transport to West European ports started in November 2018 near Honningsvåg off the northern coast of Norway, lasting until the end of June 2019 (Fig. 5). No similar transshipment of LNG has yet taken place before shipment via the eastern route to the Asian Pacific market. Only four deliveries of LNG were shipped from Sabetta to NE Asia in 2018 during the summer-autumn season, which increased to 20 deliveries in 2019 (in addition to one shipment of non-ferrous metals from the port of Dudinka).

Unlike transport of crude oil from Cape Kamenniy and non-ferrous metals from Dudinka which are transported by Russian shipping companies to Murmansk, shipments of LNG and gas condensate from Sabetta are almost inclusively being done by non-Russian companies on a long-term charter contracts (Fig. 7). These companies transporting Russian LNG are from Greece (Dynagas), UK (Teekay Shipping; LNG operations run from the UK) and Japan (Mitsui O.S.K. Lines). All three companies made joint ventures (JVs) with subsidiaries of China’s COSCO Shipping for financing the construction costs of their new fleet of Arc7 LNG carriers. Transport of gas condensate from Sabetta to the European market was done by companies from Greece and Germany.

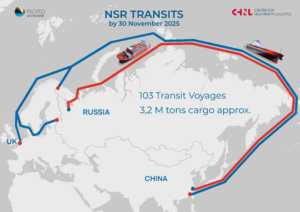

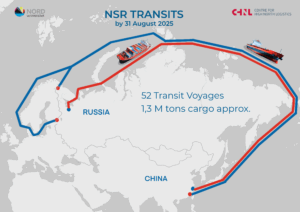

3.2.4. International transit shipping

International transit voyages via the NSR were only 8 in 2016, 12 in 2017, 17 in 2018 and 14 in 2019; or 0.4–0.8% of all the voyages during each year (Table 1 and Fig. 4).

Of the 51 international transit voyages during the four years, 47 carried cargo totaling 980,676 tons (Fig. 3). Most of the cargo originated in Asia (28 voyages or 60%) and primarily from China (19 voyages). A total of 29 voyages transported general cargo, 4 with paper pulp and 5 with frozen fish or meat. Four voyages originated in Canada (2 with coal from Vancouver, and 2 with iron ore from Baffin Island, Nunavut: 304,699 tons combined).

Here Asian companies are in the leading role, with the Chinese shipping company COSCO Shipping Specialized Carriers with 23 voyages or 45% of all international transits during the four years, follow by German companies with 25%. Additionally, COSCO made 2 transits in 2019 between western Russian ports and China and Vietnam. All international transits except two have been between NE Asian Pacific ports (China, Japan and South-Korea) and ports in NW Europe (the five Nordic countries, Germany, UK, Netherlands and France). The exceptions are two shipments of coal from Vancouver, Canada to Finland in 2016. Most of the vessels have been general cargo vessels and heavy lift carriers transporting project cargo including wind power equipment (Fig. 3).

4. Policy implications for future NSR shipping

4.1. Regular year-round shipping is limited on the NSR

NSR is not open for shipping on a year-round basis except from the Ob Bay and Yenisei River westwards via the Kara Sea. Lack of year-round shipping possibilities along the full length of the NSR is a major problem for Russia’s Arctic natural resource exploitation as future commodities are primarily meant for the Asian Pacific market. Also international shipping companies that might be interested in using the route regularly as a shortcut in transporting goods between NE Asia and NW Europe will not consider changing their transport and logistics system for a route that is only open part of the year.

But Russia is eager to open up the route to NE Asia for its abundant Arctic natural resources. Russia is already constructing three 60 MW LK60-type nuclear icebreakers and two more to follow. In addition three 120 MW Lider-type nuclear icebreakers are being planned, with the first one scheduled to be operational in 2028. All these powerful nuclear icebreakers are scheduled to operate in the more ice-infected eastern part of the NSR [21] making regular year-round shipping possible along the whole length of the NSR within the next 8–10 years. This timeframe could be shortened by further reduction in sea ice coverage and ice thickness during the winter and spring in the eastern part of the NSR and by improved icebreaking technology.

4.2. Domestic shipping is the dominant type of shipping activity on the NSR

Domestic shipping is the dominant type of shipping activity on the NSR in terms of number of voyages, with 76–92% of all voyages in 2016–2019. This is likely to continue to be the case in the foreseeable future.

Increasingly over the next several years domestic shipping on the NSR will bring large quantities of Russian Arctic oil, LNG, coal, metals, ore, grain and other natural resources on high ice-class cargo vessels from remote locations along the NSR to larger Russian hubs or dedicated transshipment terminals for temporary storage and transshipment. These hubs or terminals will be in ice-free waters outside the defined borders of the NSR and from there the commodities will be exported on conventional vessels to foreign markets.

Increased domestic shipping will also be a result of geological and geophysical exploration of Russian Arctic seas and coastal areas and in establishing, servicing, and maintaining current and future energy and mineral mining projects in the remote regions of the Russian Arctic. This includes several planned LNG and gas condensate project in the Ob Bay.

Shipping on the NSR is of high strategic and economic significance for Russia as a transport corridor along its whole Arctic coastline and as a gateway to the North Atlantic Ocean in the west and to the North-Pacific Ocean in the east. As such, the route ties together the western and northern parts of the Russian Federation with its far eastern part in the North Pacific, which is of strategic importance to Russia. Marine transport (together with limited air transport) is also the only delivery route for goods, supplies and fuels for nearly 100 remote inhabited localities on the Russian mainland Arctic coast, archipelagos, and islands. The same applies for Arctic communities along Russia’s inland waterways, which are dependent on river transport.

Domestic shipping on the NSR will play a significant role in the Russian government’s future socio-economic development of remote Russian Arctic territories [22]. The Russian government has established eight Arctic development zones along its northern boarders and has suggested several priority infrastructure projects (e.g., ports, terminals, railways, airports and power transmission facilities) within these zones [23], [24]. The proposed infrastructure projects are in support of increased natural resource exploitation and will require year-round maritime transport of energy and mineral commodities [25]. But as discussed by Tschudi [26] Russia holds great abundance of energy and mineral resources within the same geographical locations (“where gas meets ore”) which opens up future possibilities for more value-adding industrial processing in situ before shipments along the NSR.

Domestic shipping will also more than other modes of transport increase the Russian presence in the Arctic which is strategically import for Russia in terms of national security. This includes servicing and maintaining several security/military bases, search and rescue facilities, and boarder guard and surveillance stations in the Russian Arctic region. Infrastructure projects that provide both critical transport infrastructure and at the same time strengthen Russia’s security/military presence are favored by the Russian government [27].

To strengthen the role of Russian shipping industry and shipping companies operating in Arctic waters, the Russian government drafted amendments to the Russian Merchant Shipping Code that only allow Russian flag vessels to transport Russian hydrocarbon resources within NSR borders. This law came into force on February 1, 2018. These regulations did not directly impact shipping activities in the period under study here as foreign flag vessels on long-term contracts which were agreed on before this date were except from this requirement. But the regulations will have major future implications for foreign cargo vessels servicing new energy projects along the NSR. Another suggested Russian regulation would additionally require all vessels carrying hydrocarbons on the NSR to be built in Russian shipyards. These laws and regulations set the tone for Russia’s increasing control of future shipping on the NSR with its natural resources.

4.3. Future reductions to destination shipping on the NSR

Destination shipping on the NSR was 8–23% of voyages in 2016–2019. Though the share of destination shipping between the NSR and European and Asian Pacific destinations has increased during the last two years and in particular in terms of cargo volume, there will be future reductions in the number of registered voyages in this category. This is despite increasing volume of commodities being transported from the NSR.

Currently, destination shipping on the NSR involves direct transport of LNG from the Yamal LNG plant at Sabetta to Europe and NE Asia as well as deliveries of gas condensate to Europe (combined about 300 shipments or 600 voyages per year). This transportation scheme will permanently change as soon as Russia’s Novatek has constructed its scheduled transshipment and storage facilities for LNG on both the Kola Peninsula near Murmansk in the Barents Sea in the west, and on the Kamchatka Peninsula in the North Pacific in the east [28]. Both transshipment terminals are scheduled to start operations in 2023. In the meantime, temporary ship-to-ship transshipment of LNG to European destinations will be relocated from Honningsvåg off the northern coast of Norway to a site near Kildin Island close to Murmansk. These logistical changes will reduce the number of voyages in the destination shipping category and correspondingly increase the number of voyages registered as domestic voyages on the NSR.

The second important component of destination shipping on the NSR are shipments with project cargos for large-scale Russian Arctic energy and mining projects on heavy lift carriers from Asian Pacific and European ports (e.g., upcoming Arctic LNG 2 and other LNG projects in the Ob Bay).

Russia may not be as dependent on foreign companies for both the construction and shipment of prefabricated modules and other project cargos for future Arctic projects, as it was for the Yamal LNG. The experiences gained from the Yamal LNG project has enabled Russia to speed up its own LNG project development. According to President Vladimir Putin, Russia will strive to become the world’s largest LNG producer [29]. To reach the president’s goal, Russia needs to put much more emphasis on LNG technologies, engineering and plant manufacturing. To increase its share in the construction phase of future LNG projects, Russia’s Novatek is building the Kola Yard facility near Murmansk, due to be completed by 2023, to manufacture large prefabricated structural units and gravitational platforms for several upcoming LNG projects.

Destination shipping will therefore likely play less of a role in transporting future LNG modules and project cargo from outside Russia to locations within the NSR, increasingly overtaken by Russia’s own manufacturing facilities and yards. This development is likely to take several years, though. In the meantime, Russia will still be dependent on foreign shipping companies for heavy project cargo deliveries and foreign yards for module construction.

Project cargo from foreign ports transported on river barges up Russia’s waterways to industrial sites in the southern part of Russia is also likely to grow in the near future. These shipments will only take place during the summer-autumn season. The sailing window on Siberian rivers is only about three to four months, before they start freezing over again. Same applies for river transport of commodities from inland Russian territories to Arctic ports and onward shipments to Asian Pacific markets.

As was evident in 2016 and 2017 destination shipping with project cargo is project-specific and short-term in nature, without steady heavy cargo traffic and long-term transport contracts.

4.4. Several challenges for international transit shipping via the NSR

Since the shipment of iron ore from Kirkenes in northern Norway to Lianyungang in China in September 2010, the number of international transit voyages have ranged from 1 to 17 per year, during the summer-autumn season. During 2016–2019 the numbers were 8–17 or 0.4–0.8% of voyages each year. All international transit voyages on the NSR can be said to be exploratory in nature or demonstrations, but an effective way to evaluate commercial possibilities of NSR as a possible future trade route. But beyond this first step, international transit shipping is progressing very slowly.

Year-round container shipping on the NSR between NE Asia and NW Europe will be a prerequisite for the route’s full integration into the world’s transportation system. Several authors have pointed out the challenges for the development of such a container shipping business on the NSR (e.g. [30], [31]). One obvious obstacle are the ice conditions which are much more severe during winter-spring in the eastern part of the NSR [32] than in the westernmost part where year-round shipping is already taking place. But Russia’s plan is to open up the eastern part of the NSR for transport of commodities to the Asian Pacific market within the next 8–10 years with support from several powerful nuclear icebreakers. This opening will be able to accommodate international transits.

Strong support from Russia in promoting international transit shipping will be needed, both through direct infrastructure investments and by establishing international cooperation on NSR transit shipping. Russia has initiated such cooperation with China’s COSCO and with the Japanese Mitsui O.S.K Lines [33]. Russia would also need to provide reliable and efficient communication and navigational support services for transit navigation, including reliable icebreaker support [34]. But currently and likely for the foreseeable future, Russia’s focus is on its own Arctic energy and mineral development projects, not in servicing foreign vessels on international transit voyages.

5. Conclusion

Domestic shipping is the dominant type of shipping activity on the NSR and large majority of vessels are operated by Russian shipping companies. The ports of Murmansk and Arkhangelsk are acting as key service, supply and transshipment hubs for NSR shipping. Despite rapidly increasing shipping activity, year-round shipping is only taking place in the westernmost part of the NSR, in the SW Kara Sea, the Ob Bay and on the Yenisei River. Considerably more voyages are currently taking place between NSR and European ports than between NSR and ports in NE Asia. The number of European shipping companies operating vessels on the NSR is also much higher than Asian shipping companies. Russia’s focus is on natural resource exploitation in its Arctic territory, not on international transit shipping. Construction of transshipment hubs and other maritime infrastructure in support of Russian Arctic natural resource exploitation may though directly or indirectly benefit future development of international transit shipping via the NSR.

CRediT authorship contribution statement

An attempt was made to address the reviewers comments without increasing the length of the paper significantly based on the suggested limit of 6000 words.

I thank both reviewers for good comments. I have addressed all the reviewers comments as stated in the letter “Answers to Reviewers Comments.” Their suggestions for change or modification certainly will strengthen the overall quality of the manuscript.

Acknowledgements

The financial support by the Norwegian Ministry of Foreign Affairs’ ARCTIC 2030 project NOR-15/0010 is greatly appreciated. Mr. Sergey Balmasov and his team at CHNL’s Information Office in Murmansk, Russia is thanked for downloading of satellite AIS data and the management of CHNL’s NSR Shipping Database since 2016.

Declaration of interest

None.

References

[1] Arctic Marine Shipping Assessment 2009 Report, Arctic Council, Protection of the Arctic Marine Environment (PAME), 194 p., 2009. https://pame.is/images/03_Projects/AMSA/AMSA_2009_report/AMSA_2009_Report_2nd_print.pdf (Assessed 10 November 2020).

[2] T. Eriksen, Ø. Olsen

Vessel tracking using automatic identification system data in the arctic

L.P. Hildebrand, L.W. Brigham, T.M. Johansson (Eds.), Sustainable Shipping in a Changing Arctic, WMU Studies in Maritime Affairs 7, Springer International Publishing AG (2018), 10.1007/978-3-319-78425-0_7 View PDF

[3] V.M. Eguiluz, J.F. Gracia, X. Irigoien, C.M. Duarte

A quantitative assessment of Arctic shipping in 2010-2014

Sci. Rep., 6 (2016), p. 30682, 10.1038/srep30682 View PDF

This article is free to access.

View Record in ScopusGoogle Scholar

[4] G.K. Silber, J.D. Adams

Vessel operations in the Arctic, 2015-2017

Front. Mar. Sci., 6 (573) (2019), pp. 1-18, 10.3389/fmars.2019.00573 View PDF

[5] M.-A. Giguere, C. Comtois, B. Slack

Constrains on Canadian Arctic maritime connections

Case Stud. Transp. Policy, 5 (2017), pp. 355-366, 10.1016/j.cstp.2017.03.004

ArticleDownload PDFView Record in ScopusGoogle Scholar

[6] R. Chenier, L. Abado, O. Sabourin, L. Tardif

Northern marine transportation corridors: creation and analysis of northern marine traffic routes in Canadian waters

Trans. GIS, 21 (6) (2017), pp. 1085-1097, 10.1111/tgis.12295 View PDF

This article is free to access.

View Record in ScopusGoogle Scholar

[7] J. Dawson, L. Pizzolato, S.E.L. Howell, L. Copland, M.E. Johnston

Temporal and spatial patterns of ship traffic in the Canadian Arctic from 1990 to 2015

Arctic, 71 (1) (2018), pp. 15-26, 10.14430/arctic4698 View PDF

View Record in ScopusGoogle Scholar

[8] M. Humpert, Briefing Note – Arctic Shipping: An Analysis of the 2013 Northern Sea Route Season, Arctic Yearbook 2014. https://arcticyearbook.com/images/yearbook/2014/Briefing_Notes/1.Humpert.pdf.

[9] F. Lasserre, O. Alexeeva

Analysis of maritime transit trends in the arctic passages

S. Lalonde, T. McDorman (Eds.), International Law and Politics of the Arctic Ocean, Brill Academic Publishing, Leiden (2015), pp. 180-192, 10.1163/9789004284593_010 View PDF

View Record in ScopusGoogle Scholar

[10] F. Lasserre, Q. Meng, C. Zhou, P.-L. Têtu, O. Alexeeva

Compared transit traffic analysis along the NSR and the NWP

F. Lasserre, O. Faury (Eds.), Arctic Shipping: Climate Change, Commercial Traffic and Port Development, Routledge (2019)

Studies in Transport Analysis, ISBN: 978–1-351–03746-4

[11] N. Marchenko, Northern Sea Route: Modern State and Challenges, Proceedings of the ASME 33rd International Conference on Ocean, Offshore and Arctic Engineering (OMAE2014), June 8–13, San Francisco, California, USA, 10 p., 2014.

[12] A. Moe

The Northern Sea Route: smooth sailing ahead?

Strateg. Anal., 38 (6) (2014), pp. 784-802, 10.1080/09700161.2014.952940 View PDF

View Record in ScopusGoogle Scholar

[13] Y. Zhang, Q. Meng, Current Ship Traffic Analysis at Northern Sea Route, Transportation Research Board (TRB) 95th Annual Meeting Compendium of Papers 2016, Washington DC, U.S.A., 16–1187, 14 p. 2016.

[14] Y. Zhang, Q. Meng, L. Zhang

Is the Northern Sea Route attractive to shipping companies? Some insights from recent ship traffic data

Mar. Policy, 73 (2016), pp. 53-60, 10.1016/j.marpol.2016.07.030

ArticleDownload PDFGoogle Scholar

[15] Z. Zhang, D. Huisingh, M. Song

Exploitation of trans-Arctic maritime transportation

J. Clean. Prod., 212 (2019), pp. 960-973, 10.1016/j.jclepro.2018.12.070

ArticleDownload PDFView Record in ScopusGoogle Scholar

[16] X. Li, N. Otsuka Overview of recent shipping activities along the Northern Sea Route, Conference paper in Proceedings of the 8th CECAR, Tokyo, Japan, 2019. https://www.researchgate.net/publication/332472591 (Assessed 10 November 2020).

[17] A. Sergunin

Russian Approaches to an Emerging Arctic Ocean Legal Order, PCRC Working Paper No. 6

Polar Cooperation Research Centre (PCRC) Working Paper Series, Graduate School of International Cooperation Studies, Kobe University, Japan (2017)

(Assessed 10 November 2020

http://www.research.kobe-u.ac.jp/gsics-pcrc/pdf/PCRCWPS/PCRC_06_Sergunin.pdf

[18] V.V. Gavrilov

Legal status of the Northern Sea route and legislation of the Russian federation: a note

Ocean Dev. Int. Law, 46 (2015), pp. 256-263, 10.1080/00908320.2015.1054746 View PDF

View Record in ScopusGoogle Scholar

[19] A.-S. Milakovic, B. Gunnarsson, S. Balmasov, S. Hong, K. Kim, P. Schutz, S. Ehlers

Current status and future operational models for transit shipping along the Northern Sea Route

Mar. Policy, 94 (2018) (2018), pp. 53-60, 10.1016/j.marpol.2018.04.027

ArticleDownload PDFView Record in ScopusGoogle Scholar

[20] Northern Sea Route Administration (NSRA), Sailing permits on the NSR 2013–2019, 2019. www.nsra.ru/en/rassmotrenie_zayavleniy/razresheniya.html (Assessed 10 November 2020).

[21] M. Belkin, Improvement of the icebreaking capacity to guarantee year-round navigation via the Northern Sea Route, PP presentation at the International Arctic Shipping Seminar, December 12, 2019, Busan, South Korea. Organized by Youngsan University and hosted by the Korean Ministry of Oceans and Fisheries, 2019.

22] Russian Government, Development Plan for the Northern Sea Route to 2035, No. 3120-p, December 30, 2019. www.government.ru/docs/38714/ (Assessed 10 November 2020).

[23] A. Novoselov, I. Potravny, I. Novoselova, V. Gassiy

Selection of priority investment projects for the development of the Russian Arctic

Polar Sci., 14 (2017), pp. 68-77, 10.1016/j.polar.2017.10.003

ArticleDownload PDFView Record in ScopusGoogle Scholar

[24] O. Smirnova, S. Lipina, E. Kudryashova, T. Krejdenko, Y. Bogdanova

Creation of development zones in the Arctic: methodology and practice

Arct. North, 25 (4) (2016), pp. 148-157, 10.17238/issn2221-2698.2016.25.148 View PDF

View Record in ScopusGoogle Scholar

[25] M. Grigoriev

Logistical schemes for mineral commodities year-round shipment in the water area of the Northern Sea Route

Arct. Her., 2 (27) (2019), pp. 84-94

View Record in ScopusGoogle Scholar

[26] F.H. Tschudi

The Arctic Corridor – Arctic infrastructure as catalyst for Nordic resource development, Baltic Rim Economies (BRE) Review, No. 6

Pan-European Institute, University of Turku, Finland (2014)

[27] I.E. Frolov

Development of the Russian Arctic Zone: challenges facing the renovation of transport and military infrastructure

Stud. Russ. Econ. Dev., 26 (6) (2015), pp. 561-566, 10.1134/S1075700715060040 View PDF

View Record in ScopusGoogle Scholar

[28] Novatek press release, Novatek, Mitsui O.S.K. Lines and JBIC Signed Cooperative Agreement, September 26 2019. www.novatek.ru/en/press/releases/index.php?id_4=3447 (Assessed 10 November 2020).

[29] LNG World News, Putin says Russia will become world’s top LNG producer, posted on March 30, 2017, https://www.lngworldnews.com/putin-says-russia-will-become-worlds-top-lng-producer/ (Assessed 10 November 2020).

[30] F. Lasserre

Case studies of shipping along Arctic routes. Analysis and profitability perspectives for the container sector

Transp. Res. Part A: Policy Pract., 66 (2014), pp. 144-161, 10.1016/j.tra.2014.05.005

ArticleDownload PDFView Record in ScopusGoogle Scholar

[31] P. Cariou, A. Cheaitou, O. Faury, S. Hamdan

The feasibility of Arctic container shipping: the economic and environmental impacts of ice thickness

Marit. Econ. Logist. (2019) (2019), 10.1057/s41278-019-00145-3 View PDF

[32] S.R. Stephenson, L.W. Brigham, L.C. Smith

Marine accessibility along Russia’s Northern Sea Route

Polar Geogr., 32 (2) (2014), pp. 111-133, 10.1080/1088937X.2013.845859 View PDF

View Record in ScopusGoogle Scholar

[33] Mitsui O.S.K. Lines press release, Cooperation for the Development of the Northern Sea Route and Russian Far East, February 27 2018. https://www.mol.co.jp/en/pr/2018/18012.html. (last assessed on November 10, 2020).

[34] A. Moe, L. Brigham

Organization and management challenges of Russia’s icebreaker fleet

Geogr. Rev., 107 (1) (2017), pp. 48-68, 10.1111/j.1931-0846.2016.12209.x View PDF